An accidental millionaire by BitCoin

About cryptocurrencies and the evolution to a global social means of exchange

Bitcoin Bonanza: Cyprus Crisis Boosts Digital Dollars (CNBC) and other news items would suggest the Cypriotic bank crisis has helped spur the BitCoin value. “If I was looking for a store of value, I’d buy gold, wouldn’t I?” a prof told Ars Technica. “It’s a hell of a lot safer than Bitcoin.” But also hard to pay with, I’d add.

Now that BitCoin is receiving daily attention from the mainstream media and its value has risen to more than 1 thousand million Euros, it maybe a good moment to reflect on what this means and where we might want to go to.

P2P Foundation started using BitCoins in 2012

In 2012 the P2P-Foundation announced they started to have their salaries paid partly in BitCoins. Though I bought my first BTCs in 2011, I have mixed feelings about the currency. When last week we came together in Barcelona with their founder, Michel Bauwens, in Barcelona in a series of events organised in the context of the Escuela de los Commons, I brought up some of my doubts. That conversation triggered the writing of this post.

What is it and how does it work, BitCoin?

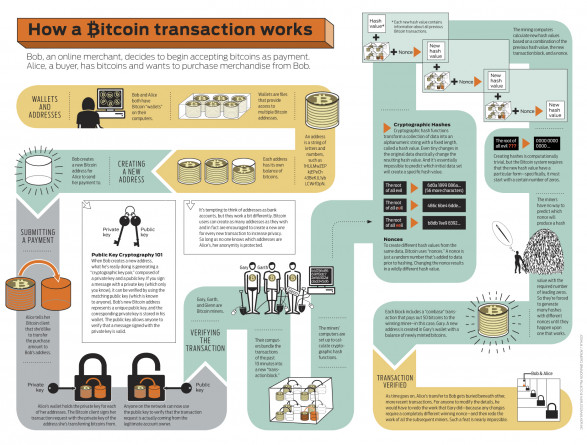

As there is already a lot of information about what it is and how it works, I won’t go into much detail here. In short it is the first peer to peer digital currency, a cryptocurrency. Unlike fiat currencies like the Euro, Dollar and Renminbi, BitCoin has no central authority that can manipulate the value or quantity in circulation.

Its distributed nature makes it possible to avoid banks completely: you pay directly from one computer to another, no intermediaries are necessary, and once you perform the transaction, it cannot be revoked (this one feature already makes it disruptive). The money supply is automated, limited, divided and scheduled, and given to servers or “bitcoin miners” that verify bitcoin transactions and add them to a decentralised and archived transaction log every few minutes.

BitCoin came into circulation on January 3rd 2009 and while 4 years may be a short period, already a large network of people and organisations has started to use BitCoin.

At visual.ly they say it with infographics:

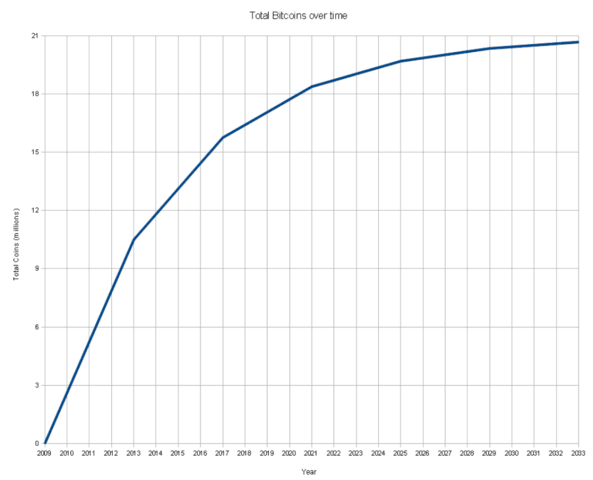

The value of the BitCoin economy is thus depending on the predictable curve of the number of coins in circulation (see chart on the right) and the less predictable number of users and demand for BitCoin. When more people start using it and the demand for BitCoins increases, its value will logically rise. This is what's been happening the last 15 months or so (see chart below on the value in US$ over the last 18 months). Many early adopters have become millionaires by accident, by experimenting with this innovative technology.

That's very nice for the early users - quite a few got millionaires-, but makes it hard to use it in practice. It has come to such an absurd situation that it seems more interesting to keep your coins than using them for actually buying things: the value of the BitCoin might continue to rise as it did until now. The few coins I bought by the end of 2011 all of a sudden have come to be valued as much as a few months rent. If the rise continues, I'd become a millionair (in Euro terms) in a period ranging from less than a year to two years, depending if we extrapolate from the time I bought the coins or since January this year. Even though it's very hypotethical, it's outrageous! Still the idea that BitCoin would be a pyramid system has been refuted.

About demurrage and FreiCoin

When we are thinking of designing social currencies, one particular element is valued in the currency we would like: that it is used as a means of exchange, and not so much as a menas for storing value. Typically the official currencies we know have both functions (as does BitCoin) and that may be one of the reasons capitalism has worked so well for the people storing huge amounts of capital, the 1% so to say.

Designing for only a means of exchange, a currency that stimulates circulation, we get to Silvio Gesell, a German anarchist economist and enterpreneur who coined the idea of FreiGeld (Free Money) a century ago. According to Gesell, all human-produced goods are subject to expensive storage, whereas money is not: Grain loses its weight, metal products rust, housing deteroriates. He suggested to introduce a storage cost for money, to incentivise people to use it instead of storing it. This is the concept of "demurrage". Experiments with currencies designed with demurrage fees have shown a more dynamic economy, where money is changing hands more than in conventional money economies.

FreiCoin is a cyptocurency like BitCoin (it is in fact a fork of the latter). Unlike Bitcoin, Freicoin has a demurrage fee that ensures its circulation and bearers of the currency pay this fee automatically. FreiCoin just released its version 0.0.2 and is not much used at the moment. However the ideas behind it might appeal to many of the current social currencies that operate in alternative and social economies. As Bernhard Lietaer has pointed out, the monetary system determines whether we value short or long term investments. With positive interest rates we tend to value more the present value. In other words: with positive interest rates it pays to be a vulture capitalist. "With 0% interest rates we could value things in the future as much as we value them in the present: money wouldn’t have any effect on our “time preference,” which may change with the current circumstances of each person and his or her own priorities."

FreiCoin is designed (see the basics and how it works) so that 100 million coins come into circulation, 20% are mined by the nodes of the network and 80% are distributed by the FreiCoin Foundation. This last part might sound a bit scary: the distribution of such large part of the currency might seem arbitrary. Check out the strategies to distribute to an as wide as possible part of the global (Internet) community on their forums.

About time banks, debt networks, WIR and Ripple

Money is a social convention, as Aristotle already wrote. Even gold would only be worth a fraction of its current market value if we didn't come to see it as a store of value. Anthropologist David Graeber concludes in his extensive history of 5000 years of Debt that in many societies throughout history local currency systems have been worked out on the basis of a debt network. Members of a community all owed to each other and at a certain point they cancelled out these debts - even without the need for physical coins. Money in that sense was already "virtual". Let us see a few examples.

Time banks are a recent phenomenon to reinstall debt networks where people pay with their time. It also normalises hourly tariffs, so that a for example massagist or language teacher gets the same hourly tariff (namely one "hour" in their local currency) for his work as a computer expert. Nowadays many cities and villages have their own timebank.

An older complementary currency that is in use for over 75 years in Switzerland is the WIR. It is a debt network that serves small and medium-sized businesses and retail customers. It exists only as a bookkeeping system to facilitate transactions. Studies have shown that the WIR has strengthened resilience in economic down times.

Ripple is a monetary system based on trust that already exists between people in real-world social networks. By cutting out the institutional middlemen, Ripple is both more community-oriented and more efficient as a means of exchange. Ripple is a monetary system that makes simple obligations between friends as useful for making payments as regular money. It is an open, distributed p2p payment network that operates in any currency you would like to transfer. See also: https://ripple.com/

There are also various projects that facilitate tools to democratise money, such as Cyclos developed by STRO/Social Trade, and in particular for the creation of distributed cryptocurrencies, such as Open Transactions (1,2) and "FreeCoin" in development by Dyndy.

As we have seen before with BitCoin, the stability of the network is essential to make it practically useful. From Control Systems theory we can learn about "BIBO Stability": Bounded Input, Bounded Output. "Essentially, the scientific conclusion is that the suppression of peoples commercial autonomy and freedom is NOT required in order to maintain a stable and trustworthy currency. On the contrary, it is only by allowing people to create money as they exchange real goods and services in stable transactions that both stability of the unit and prosperity can be achieved."

About taxes and rethinking the state

While we can think of BitCoin as just another form of money, it may be clear that the system enables people to make anonymous payments, and are thus hard to trace for the IRS. This may add up to the income problems many countries are experiencing, it definitely isn't the only issue. For many reasons a debate is needed to rethink and redefine the State. The centralised top-down organised State is in crisis. And while in many countries the State can't provide sufficiently for the majority of its inhabitants, a more bottom-up organised model would seem to be preferable by a growing group of people. A state that partners with the people to strengthen the commons and enable people to create value both individually as collectively. Michel Bauwens suggests the Partner State. If we can assure inclusion of all inhabitants, I think we'll be on the right path.

Energy consumption

Some criticise BitCoin for the energy that is consumed by the servers in the network. It is estimated that energy costs amount to more than 150.000 US$ (check for the up-to-date numbers at http://blockchain.info/stats), which may cost around 40 US$ per BTC by mid-April 2013. Is that much? If we compare with only the buildings that the financial system uses to house banks, I think we can easily conclude that it is really a tiny bit. FreiCoin is estimated to consume 20US$ per block which contains 730 FRC, which would make just a few cents per FRC. Though this will increase when FreiCoin increases in popularity. An ideal currency wouldn't consume energy, but then how would it be a secure currency?

Conclusions

While some point at BitCoin as a virtual currency as if that were differentiating from state-backed money, others wonder whether not all currencies are virtual. Aristotle said that there is no intrinsic value in a currency, but it is what the people define it to be, what kind of rules they agree upon. What does make BitCoin unique is its fully distributed nature, that there are no central authorities and that users can transfer their value from one computer to another directly. We have observed some of the flaws of this experiment, that its value fluctuates enormously and above all is hard to predict. That makes it more difficult to use it as a day-to-day form of exchange, as Internet cash so to say. Jaromil has described BitCoin as the "end of the taboo on money", in the sense that finally we have started to critically think of our currency system and explore alternatives to it.

And that is I think the most valuable part of BitCoin: that it has opened up our imagination to design a social currency that can be as direct as p2p, through a distributed network. But at the same time we have to continue evolving until we get to a socially attractive tool that we can use as our instrument to exchange both locally and globally and that help us create wealth, for the 99%. I think one of the most important elements is the participation of social networks, activist networks, local communities, fablabs and global villages. I look forward to see an explosion of cryptocurrency activity!

The value of the BitCoin economy is thus depending on the predictable curve of the number of coins in circulation (see chart on the right) and the less predictable number of users and demand for BitCoin. When more people start using it and the demand for BitCoins increases, its value will logically rise. This is what's been happening the last 15 months or so (see chart below on the value in US$ over the last 18 months). Many early adopters have become millionaires by accident, by experimenting with this innovative technology.

That's very nice for the early users - quite a few got millionaires-, but makes it hard to use it in practice. It has come to such an absurd situation that it seems more interesting to keep your coins than using them for actually buying things: the value of the BitCoin might continue to rise as it did until now. The few coins I bought by the end of 2011 all of a sudden have come to be valued as much as a few months rent. If the rise continues, I'd become a millionair (in Euro terms) in a period ranging from less than a year to two years, depending if we extrapolate from the time I bought the coins or since January this year. Even though it's very hypotethical, it's outrageous! Still the idea that BitCoin would be a pyramid system has been refuted.

About demurrage and FreiCoin

When we are thinking of designing social currencies, one particular element is valued in the currency we would like: that it is used as a means of exchange, and not so much as a menas for storing value. Typically the official currencies we know have both functions (as does BitCoin) and that may be one of the reasons capitalism has worked so well for the people storing huge amounts of capital, the 1% so to say.

Designing for only a means of exchange, a currency that stimulates circulation, we get to Silvio Gesell, a German anarchist economist and enterpreneur who coined the idea of FreiGeld (Free Money) a century ago. According to Gesell, all human-produced goods are subject to expensive storage, whereas money is not: Grain loses its weight, metal products rust, housing deteroriates. He suggested to introduce a storage cost for money, to incentivise people to use it instead of storing it. This is the concept of "demurrage". Experiments with currencies designed with demurrage fees have shown a more dynamic economy, where money is changing hands more than in conventional money economies.

FreiCoin is a cyptocurency like BitCoin (it is in fact a fork of the latter). Unlike Bitcoin, Freicoin has a demurrage fee that ensures its circulation and bearers of the currency pay this fee automatically. FreiCoin just released its version 0.0.2 and is not much used at the moment. However the ideas behind it might appeal to many of the current social currencies that operate in alternative and social economies. As Bernhard Lietaer has pointed out, the monetary system determines whether we value short or long term investments. With positive interest rates we tend to value more the present value. In other words: with positive interest rates it pays to be a vulture capitalist. "With 0% interest rates we could value things in the future as much as we value them in the present: money wouldn’t have any effect on our “time preference,” which may change with the current circumstances of each person and his or her own priorities."

FreiCoin is designed (see the basics and how it works) so that 100 million coins come into circulation, 20% are mined by the nodes of the network and 80% are distributed by the FreiCoin Foundation. This last part might sound a bit scary: the distribution of such large part of the currency might seem arbitrary. Check out the strategies to distribute to an as wide as possible part of the global (Internet) community on their forums.

About time banks, debt networks, WIR and Ripple

Money is a social convention, as Aristotle already wrote. Even gold would only be worth a fraction of its current market value if we didn't come to see it as a store of value. Anthropologist David Graeber concludes in his extensive history of 5000 years of Debt that in many societies throughout history local currency systems have been worked out on the basis of a debt network. Members of a community all owed to each other and at a certain point they cancelled out these debts - even without the need for physical coins. Money in that sense was already "virtual". Let us see a few examples.

Time banks are a recent phenomenon to reinstall debt networks where people pay with their time. It also normalises hourly tariffs, so that a for example massagist or language teacher gets the same hourly tariff (namely one "hour" in their local currency) for his work as a computer expert. Nowadays many cities and villages have their own timebank.

An older complementary currency that is in use for over 75 years in Switzerland is the WIR. It is a debt network that serves small and medium-sized businesses and retail customers. It exists only as a bookkeeping system to facilitate transactions. Studies have shown that the WIR has strengthened resilience in economic down times.

Ripple is a monetary system based on trust that already exists between people in real-world social networks. By cutting out the institutional middlemen, Ripple is both more community-oriented and more efficient as a means of exchange. Ripple is a monetary system that makes simple obligations between friends as useful for making payments as regular money. It is an open, distributed p2p payment network that operates in any currency you would like to transfer. See also: https://ripple.com/

There are also various projects that facilitate tools to democratise money, such as Cyclos developed by STRO/Social Trade, and in particular for the creation of distributed cryptocurrencies, such as Open Transactions (1,2) and "FreeCoin" in development by Dyndy.

As we have seen before with BitCoin, the stability of the network is essential to make it practically useful. From Control Systems theory we can learn about "BIBO Stability": Bounded Input, Bounded Output. "Essentially, the scientific conclusion is that the suppression of peoples commercial autonomy and freedom is NOT required in order to maintain a stable and trustworthy currency. On the contrary, it is only by allowing people to create money as they exchange real goods and services in stable transactions that both stability of the unit and prosperity can be achieved."

About taxes and rethinking the state

While we can think of BitCoin as just another form of money, it may be clear that the system enables people to make anonymous payments, and are thus hard to trace for the IRS. This may add up to the income problems many countries are experiencing, it definitely isn't the only issue. For many reasons a debate is needed to rethink and redefine the State. The centralised top-down organised State is in crisis. And while in many countries the State can't provide sufficiently for the majority of its inhabitants, a more bottom-up organised model would seem to be preferable by a growing group of people. A state that partners with the people to strengthen the commons and enable people to create value both individually as collectively. Michel Bauwens suggests the Partner State. If we can assure inclusion of all inhabitants, I think we'll be on the right path.

Energy consumption

Some criticise BitCoin for the energy that is consumed by the servers in the network. It is estimated that energy costs amount to more than 150.000 US$ (check for the up-to-date numbers at http://blockchain.info/stats), which may cost around 40 US$ per BTC by mid-April 2013. Is that much? If we compare with only the buildings that the financial system uses to house banks, I think we can easily conclude that it is really a tiny bit. FreiCoin is estimated to consume 20US$ per block which contains 730 FRC, which would make just a few cents per FRC. Though this will increase when FreiCoin increases in popularity. An ideal currency wouldn't consume energy, but then how would it be a secure currency?

Conclusions

While some point at BitCoin as a virtual currency as if that were differentiating from state-backed money, others wonder whether not all currencies are virtual. Aristotle said that there is no intrinsic value in a currency, but it is what the people define it to be, what kind of rules they agree upon. What does make BitCoin unique is its fully distributed nature, that there are no central authorities and that users can transfer their value from one computer to another directly. We have observed some of the flaws of this experiment, that its value fluctuates enormously and above all is hard to predict. That makes it more difficult to use it as a day-to-day form of exchange, as Internet cash so to say. Jaromil has described BitCoin as the "end of the taboo on money", in the sense that finally we have started to critically think of our currency system and explore alternatives to it.

And that is I think the most valuable part of BitCoin: that it has opened up our imagination to design a social currency that can be as direct as p2p, through a distributed network. But at the same time we have to continue evolving until we get to a socially attractive tool that we can use as our instrument to exchange both locally and globally and that help us create wealth, for the 99%. I think one of the most important elements is the participation of social networks, activist networks, local communities, fablabs and global villages. I look forward to see an explosion of cryptocurrency activity!